A Currency Board for Lebanon?

Ishac Diwan and Alain Bifani, updated, July 2021

With inflation and devaluation accelerating, some voices are advocating a currency board (CB) for Lebanon. The appeal to its supporters is the perspective of anchoring the Lebanese Lira (LL) so as to avoid devaluation and inflation spiraling out of control. This involves disciplining the government to stop running fiscal deficits, and the Banque du Liban (BdL) to stop its excessive printing of LL to finance the deficit and large withdrawal from bank deposits. There is no doubt that the BdL injection of large amounts of liquidity is the main source of inflation and devaluation. It is thus understandable that people behind the idea of a CB would want to avoid such behavior in the future. We also understand perfectly well the idea of using the CB as a stick to bring careless rulers to reason. Nevertheless, we would like to privately share our views regarding a CB in Lebanon today, in case this option becomes serious.

A CB is a fixed exchange rate (XR) system that is guaranteed by an institution and laws in ways to ensure the credibility of the peg.i A new currency (the “Strong Lira”) would be made perfectly convertible at a given XR by being completely backed by liquid foreign assets (such as dollars or gold), available upon demand. If the BdL is transformed into a CB, it becomes unable to “print” Liras, unless it can provide FX reserves to “cover” them.

A CB is costly to implement, as it requires that (marketable) assets be devoted to its operation. To give a sense of magnitude, M1 is currently at about 100 T LL. Depending on the exchange rate at which the LL would be converted (say between 6K and 10K), this would require that $10 to 15 billion are put aside as assets of the CB.

We think that a CB is a bad idea for Lebanon today. It is not a substitute for the reform package that Lebanon urgently needs, involving public debt reduction, fiscal adjustment, bank and central bank restructuring, a fair distribution of losses, efficient social safety nets and external support. But it makes the acceptance of such a package harder. There are two problems that arise: less assets are available to resolve the banking crisis; and if the banking crisis is not resolved before hand, there will be a rush to transfer deposits (M2) into cash, which would create a run on the CB.

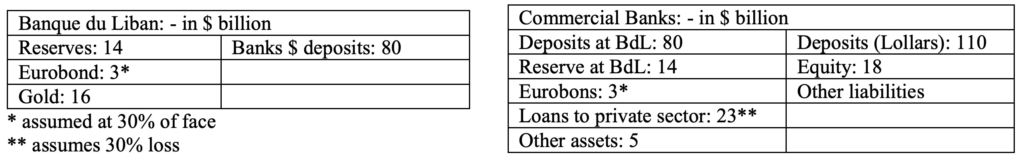

On the first issue, it is important to realize that the main difficulty in resolving the current banking crisis is the scarcity of foreign assets that can be used for this purpose. These assets include BdL’s liquid reserves ($14 billion according to BdL and unaudited), gold reserves ($16 billion), and the value of the Eurobond debt it holds – with a market value about $3 billion). These thus add up to about $33 billion (in real $). If all of this was used to support the banking restructuring, the about $110 Lollar of remaining dollar deposits would require a haircut of about 40% for banks’ balance sheets to be made whole (with the first $18 billion of losses taken up by bank equity). If instead, only $23 b were used for banking resolution, then the average haircut would stand at 50%.

The problem is not just that the creation of a CB makes a banking resolution harder, but rather, than in these circumstances withdrawals from banks should be limited to the rise in dollars in the CB. Unless this happens, there will be a run on reserves, resulting in its collapse. This is because a CB only covers base money – currency in circulation and banks reserves (M1). While in other environments, the CB can count on the banking system to stabilize deposits though liquidity management – such as raising interest rates – if too many deposits get converted into liquid assets and/or foreign exchange, this cannot be done in Lebanon today. In the midst of an ongoing bank run, and with the net value of banks negative, rational depositors will rush to shift their funds into the new SL rather than hold claims on a bankrupt bank. Thus, a CB can only work after the banking crisis is resolved, or in the current circumstances, bank accounts are all frozen forever.

More generally, beside a CB, and banking deposits, there are also other claimants to these same assets: future fiscal deficits (to finance a SSN, higher wages); subsidies (essential drugs and food), and a recapitalization of the National Social Security Fund in particular. To pledge a third of national assets to a CB requires a very pressing reason to do so.

From an economic perspective, a CB provides not just advantages, but also costs. The benefit is to anchor the Lira. But on the other side of the ledger, a CB creates a straightjacket for years to come that does not allow monetizing the budget deficit when needed; and that does not allow the currency to devalue so as to boost exports and restrict imports when needed. These are hugely constraining commitments, in the short and medium terms. A hard budget constraint, if no new foreign funding were available, would push real wages in the public sector (including the armed forces) to extremely low values. And over time, a fixed rate would, as in the past, make the country uncompetitive.ii A CB would also leave the financial sector unprotected, without a lender of last resource. Each of these constraints will hurt the recovery if/when Lebanon starts on a new economic path based on productivity and exports. A reformist government would find it impossible to restart growth if its hands are tied in this manner. So at best, a CB can be valuable if we consider that Lebanon has no growth opportunities, and will continue to have non-reformist governments, bent on spending resources they do not have.

CB are typically implemented in situations different from those in Lebanon, when inflation is accelerating due to the monetization of deficits followed by organized labor pushing for larger nominal wages, leading to an inflationary spiral. In fact, CBs are specifically not recommended for countries with a banking problem.iii The fiscal deficit is a problem in Lebanon, but not the larger problem: inflation is caused much more by the lack of trust in the banking sector and in the Lebanese Lira. This needs to be fixed through debt reduction and banking sector restructuring.

In sum, the CB regime is an inappropriate recipe for the country’s current problems. As is clear from our analysis, we are wholly against it. The best way to go is clear. Too much time has already been lost looking for a mirage solution and refusing to accept past losses and distribute them fairly in society. A properly executed rescue and stabilization package, implemented a year ago, with international support, would have stabilized the exchange rate at between 3000 to 5000 to the dollar, and gotten the country back on a growth path

by now. It is not too late to do the right thing. The alternative is a deeper fall and more misery.

Simplified $ balance sheet of banks and BdL, March 2021

Note

- haircut 1: 110 of deposits receive: (33+3+23+5)=64; i.e 0.58 of face

- haircut 2: 110/(23+3+23+5)=54/110 = .49 of face

i Countries with an ongoing CB include, besides Hong Kong, very small economies (St Vincent, St Lucia, St Kitts, Grenada, Djibouti, Brunei, Antigua, Dominica); and Eastern European countries in transition to the Euro (Estonia, Bulgaria, Lithuania). While Hong Kong has managed its system in strictly conservative ways, with 100% FX cover, Argentina (1991-2001) used domestic securities extensively. For a definition and a discussion of challenges, see: Corrinne Ho: A survey of the institutional and operational aspects of modern-day currency boards. BIS, Monetary and Economic Department. BIS Working Papers No 110. March 2002.

ii Lebanon has followed an unofficial peg since 1993, with BdL fixing the currency at 1507.5 liras to the dollar from 1997 until 2019. This peg was the principal reason that led to the massive

accumulation of losses at BdL. Since the financial crisis started and the access to dollar deposits became highly restricted, dollars in bank accounts became known as local dollars, or Lollars for short. Black market rate for real fresh dollars are close to 15,000 liras. Lollars can be withdrawn

from banks in limited quantity (typically a maximum of $500/month as of end 2020), at a rate of

3900 liras per Lollar.

iii Charles Enoch and Anne-Marie Gulde. Are Currency Boards a Cure for All Monetary Problems? IMF blogs, December 1998.